Disclaimer: This article/guide/resource is to be used for informational purposes only and does not constitute financial, business, legal or tax advice. Individuals/businesses should consult with their own accountant, business advisor, or tax advisor with respect to matters referenced in this article/guide/resource. Affinity Ledger assumes no liability for actions taken in reliance upon the information contained herein see [Terms and Conditions]. Copyright: All Works on displayed on hubpoint.info are copyrighted unless otherwise stated:

Single Entry Accounting in Bookkeeping

What is Single Entry Accounting?

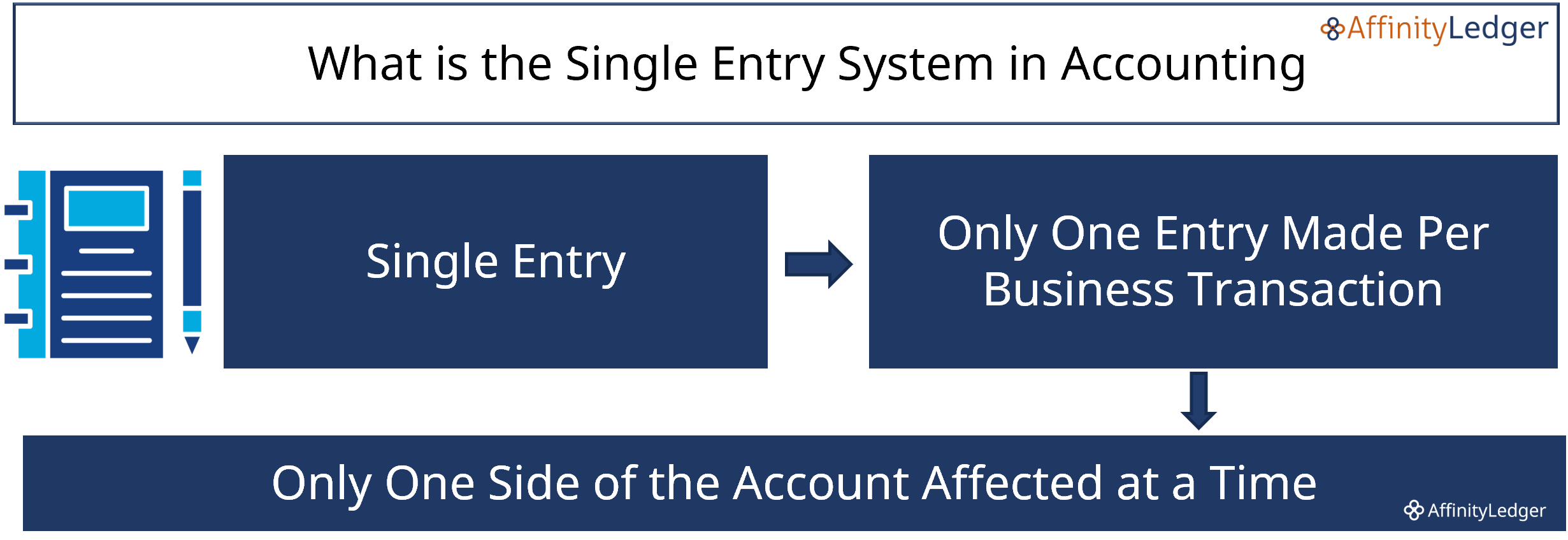

Single Entry Accounting in Bookkeeping is a straightforward method of recording business transactions. This accounting method is based on one single entry into the books per business transaction, therefore aptly name single entry bookkeeping.

Each transaction requires only one single entry, typically into a cash book, with the transactions comprising of sales and expenses. This simplistic method is based on the production of the profit/loss report.

The process of entering the transactions is known as single entry bookkeeping. Single entry bookkeeping is a simple method, and no technical skills or training are normally required. There is no software requirement if you use paper based cash books, so it is cheap, and you do not need to hire a bookkeeper.

What is the Purpose of Single Entry Accounting?

The main aim of single entry accounting is to calculate profit. The result of recording income and expenses and deducting expenses from income will be a net profit/loss figure. The profit/loss report is based around income and expenses and this is the report that can be produced by single entry bookkeeping activities.

Advantages of Single Entry Accounting in Bookkeeping

The simplicity of the single entry accounting method is very appealing and it can work very well for many small businesses.

- Cheap to set up no investment in bookkeeping software

- No bookkeeping experience required (basic maths skills)

- Simple to use, similar to a personal bank account

- Weekly/monthly income figures

- Information to help complete SA100 Self-Assessment

- Complete control of your business finances

- No (or limited) accounting professionals fees

Disadvantages of Single Entry Accounting in Bookkeeping

Although simplistic the single entry method has its own set of disadvantages: .

- Time consuming and cumbersome

- High incidence of errors

- Chance of fraud, due to single transaction only

- Incomplete records (Only income and expenses recorded)

- Difficult asset and liability tracking (which could lead to losses)

- Inadequate valuation of financial information (due to errors, missing transactions, and incomplete records)

- Possibility of fines, penalties, or tax overpayments (due to incorrect reporting of taxable profit or loss)

Who is Single Entry Accounting Suitable For?

The single entry accounting method maintains the cash account, and sometimes creditors and debtors. It does not maintain, liabilities, asset, and capital accounts. The result of these missing accounts means that single entry accounting is classed as incomplete.

Business types such as sole traders or partnerships, often find the single entry method to be a useful tool to get started, particularly if they want to carry out their own bookkeeping.

Some low revenue LTD Companies can use this method as long as a bookkeeper or accountant completes their records to produce a balance sheet and performs other necessary accounting duties such as deprecation of any assets, prepayments, accruals and owners’ equity etc.

Single Entry Accounting is most suited to business’ with the following criteria

- Mainly service based

- Unincorporated business

- Low volume transactions

- No assets such as vehicle or plant

- Revenue below the VAT threshold

Single Entry Vs Double Entry Accounting

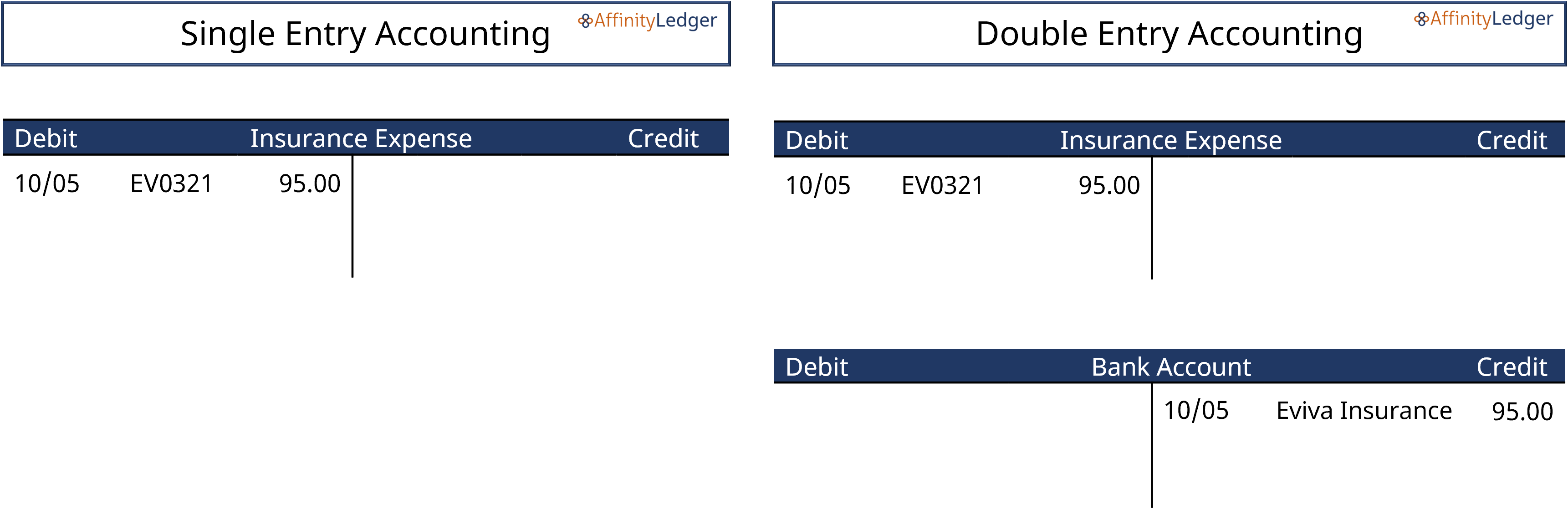

The counterpart to single entry accounting is double-entry accounting. With this method, there is a minimum of two entries per business transaction as opposed to one with single-entry. The process of entering transactions using this method is known as Double Entry Bookkeeping.

In the example below a business purchase insurance

- Single Entry Transcation one entry into insurance expense or money out.

- Double Entry Transaction, two entries, insurance expense and bank account

Where are Transactions Recorded?

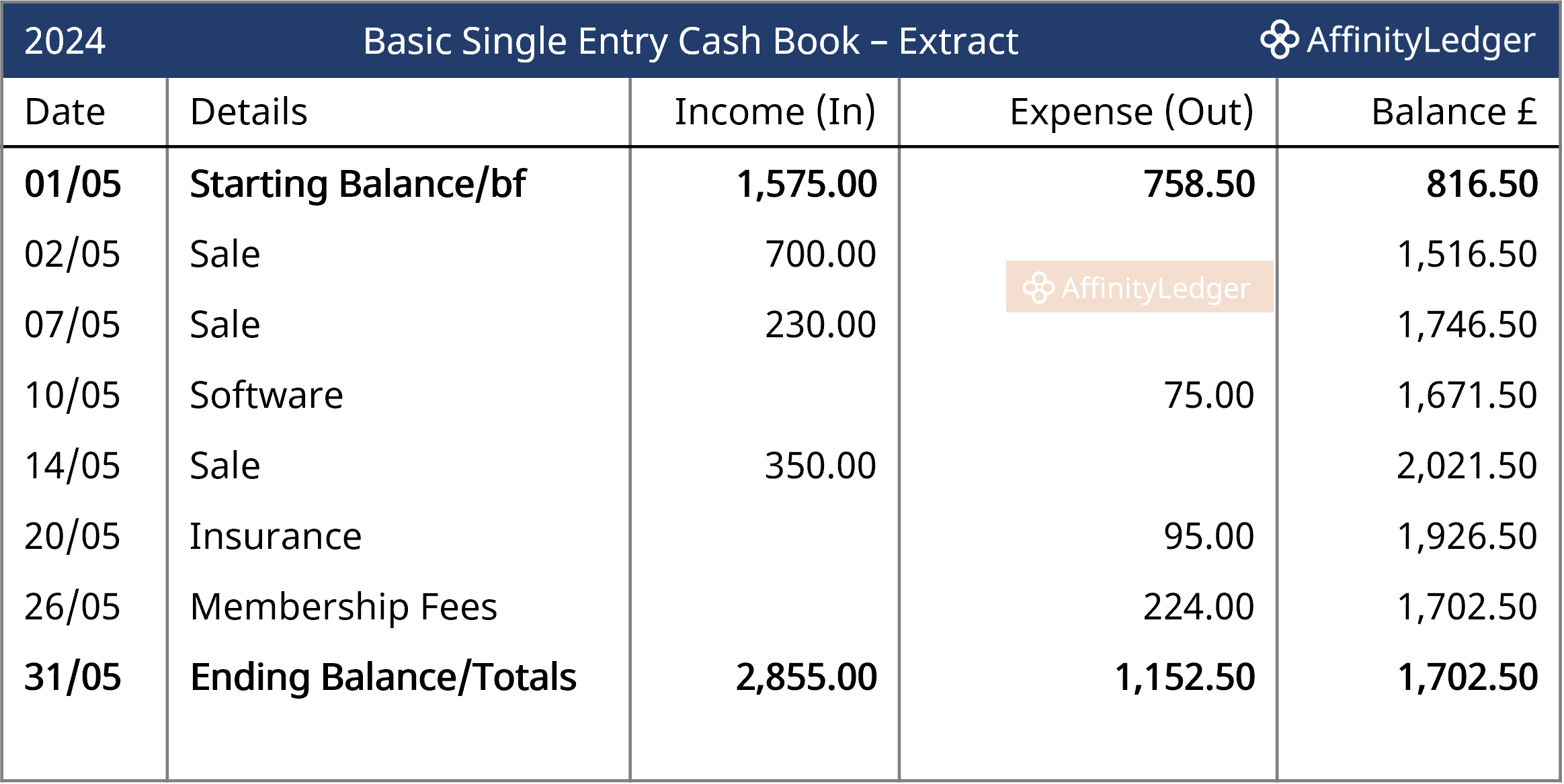

The cash book is a vital element in a single entry system. Recorded here is all the money coming in and going out of your business, there are basic and expanded versions showing column’s for the most common expenses, below is a basic version of the cashbook

The result of the consistent recording of all your business transactions are grand totals at the end of the year for income and expenses. These totals form the starting point for the compilation of your income statement.

How are Transactions Recorded?

Recording transactions using the single entry method is very simple. Sales are recorded on one side of the cash book and expenses on the other. Drawings are recorded separately. Recording takes the form of money in and money out.

Each transaction includes the date a reference number, brief details and the amount. A grand total is calculated at the end of the period normally a month.

Tip: If you take cash from your business for personal use do not record this in your cash book as an expense, this withdrawal is classed as owners drawings it will reduce your bank balance but not your profit.

Who Can Do Single Entry Accounting?

The simplicity of single entry means most people can do it. There are no special skills required. That being said certain qualities are attributes are useful.

- Ability to set up a simple system

- Basic numerical skills

- Being organised

- Consistency

- Attention to detail

- Problem solving

Equipment for Single Entry Accounting

Success in single entry starts with choosing a method of recording transactions. Paper-based or if you are PC literate Excel based.

Cashbook printed or electronic is the central part of a single-entry system. Access to a laptop/pc is vital if using excel based cash book and submission of a self-assessment tax return. For recording purposes use a sales receipt book, files for storing paperwork, a simple calculator, and a petty cash tin if you receive cash payments.

Keeping business and personal cash separate is vital to the success of your bookkeeping activities. This is where a business bank account will be beneficial. It provides the ability to track money coming in and going out and the capacity to view the balance at any given time.

Single Entry Accounting System for Business

Many sole traders and general partnerships find that single entry is sufficient to meet the needs of their business. Private Companies are required to submit thier accounts to Companies House and for this purpose they need to use double-entry accounting.

Are you thinking of using single entry accounting to carry out your bookkeeping? If the answer is yes, check out our single entry accounting system guide.